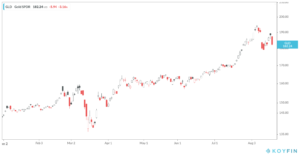

Big market movies demand an explanation, relevant or otherwise. Two weeks ago my co-authors and I published a paper on the price of gold relative to its long history the timing could not have been better.

Gold promptly went onto one of its worst one day declines in the past seven years. Was this a coincidence? Yes. Is it also a fun anecdote? Yes, as well.

Last week on SSRN our paper had the second most downloads, first if you take into account only finance-related stuff. So you can say that interest in anything gold-related is pretty high.

As with big market moves, gold or otherwise, there is no shortage of explanations for what is going on. As you can guess with anything gold-related there has been a range of reactions and hot take headlines. We recommend you download the paper and read the whole thing for yourself. Otherwise you can check out some of the pieces citing the paper below:*

Now might not be the best time to buy gold (Larry Swedroe)

Gold is a foolish place to put your money right now if you check the facts (Mark Hulbert)

What’s driving the price of gold? (Michael Batnick)

What’s driving the new gold rush? (Fortune)

How the 2020 gold rush smashed through records (FT)

Gold may disappoint long-term (The Irish Times)

The next bubble: passive investing in ETFs (CNN)

Liking gold’s ascent? Just wait for the plunge, study warns (CIO)

Gold is tricky to invest in current based on the facts (Cryptovibes)

ETF boom fuels gold’s sharp rise. (WSJ)

Does gold do what it is supposed to do? (Alpha Architect)

How long can the gold rally last? (Forbes)

Investors hoard gold, Bitcoin and whiskey to soothe inflation fear (Bloomberg)

*Will add more items as they become available.